IN ACCORDANCE WITH THE CARES ACT, THE CORONAVIRUS-RELATED DISTRIBUTION PROVISIONS DESCRIBED BELOW EXPIRE ON DECEMBER 31, 2020. ALL CRD REQUESTS MUST BE SUBMITTED AND APPROVED BY AN AUTHORIZED PLAN REPRESENTATIVE BY NOON (ET) ON DECEMBER 28TH.

Eligibility

The CARES Act requires that the participant must be affected by the coronavirus pandemic to request a coronavirus-related distribution (CRD). To be eligible for a CRD, the participant, their spouse or dependent must have either been diagnosed with COVID-19 or the participant must have suffered adverse financial impact due to COVID-19 as a result of the participant, their spouse, or a member of the participant's household:

- being quarantined, being furloughed or laid off, or having work hours reduced due to COVID-19;

- being unable to work due to lack of childcare due to COVID-19;

- closing or reducing hours of a business that they own or operate due to COVID-19;

- having pay or self-employment income reduced due to COVID-19; or

- having a job offer rescinded or start date for a job delayed due to COVID-19.

Coronavirus-related distribution (CRD) provisions:

- Withdrawal up to $100,000 (across all plans)

- No 10% early withdrawal tax penalty

- Taxation at point of distribution can be waived

- Can be paid back to the plan over 3-year period

- Participant must self-certify to their qualification

- Withdrawals can be made until 12/31/2020.

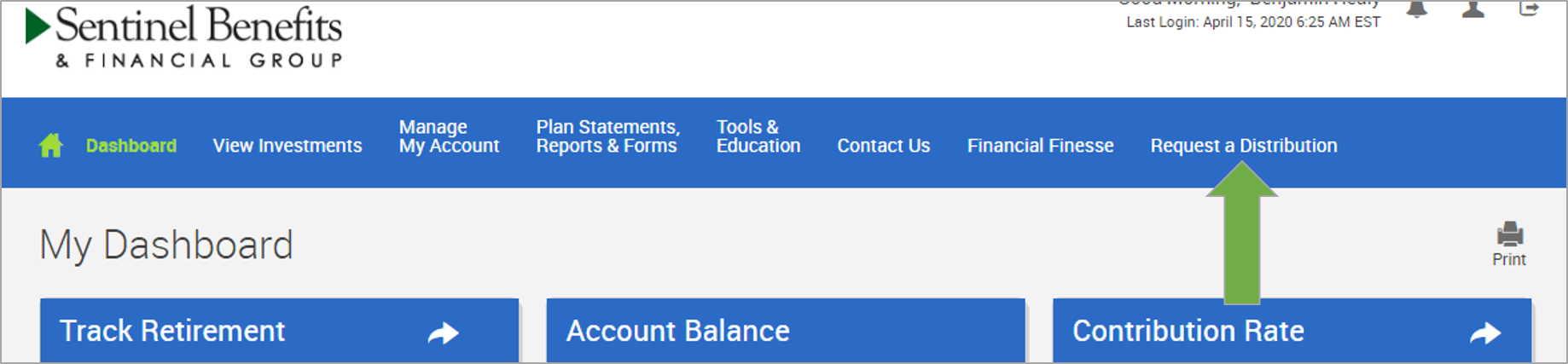

Participant Request

- Initiated through the Participant's online account

- Available from all sources

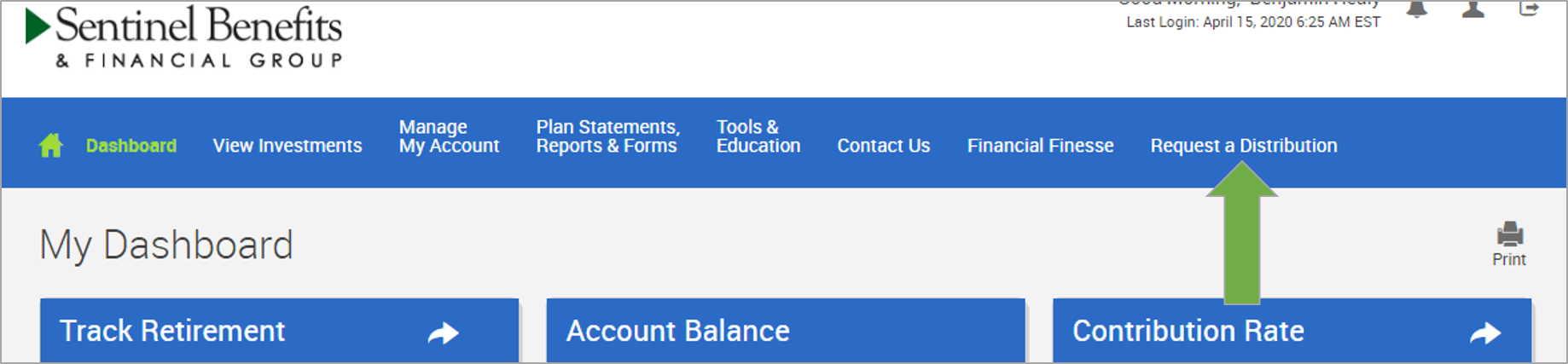

- Once logged in, participant can select Request a Distribution from the navigation bar

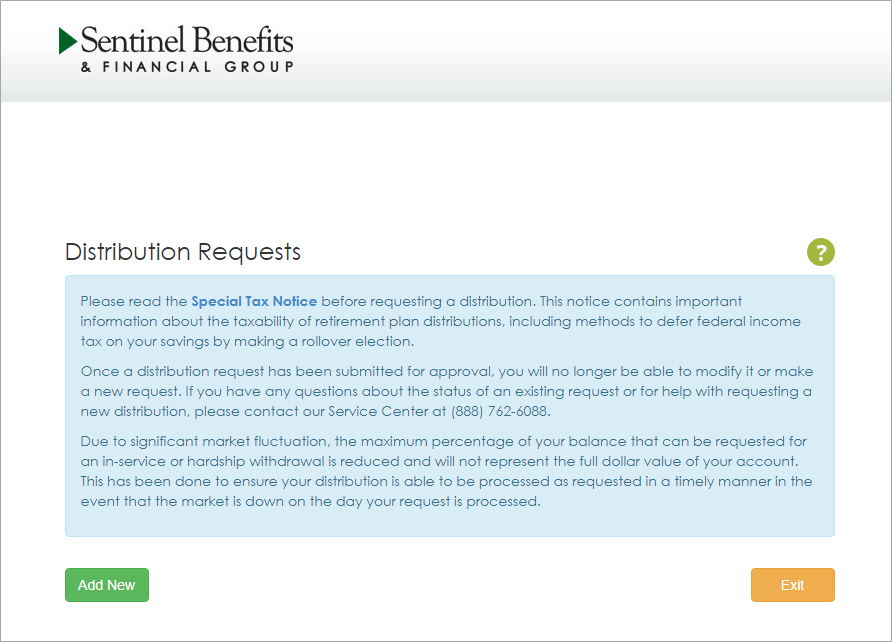

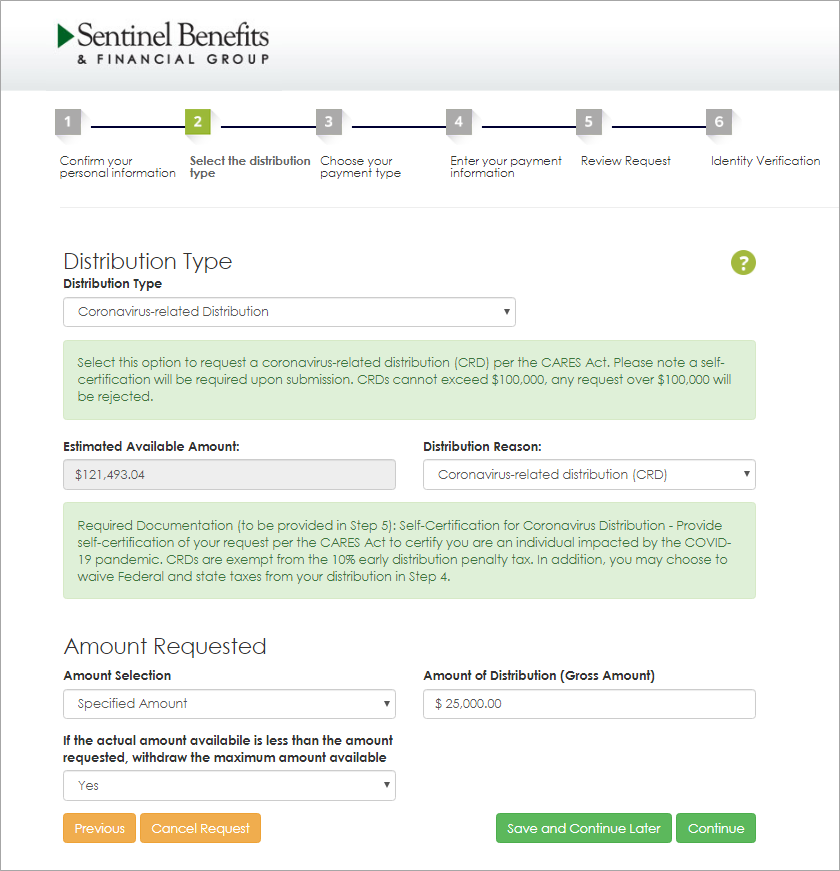

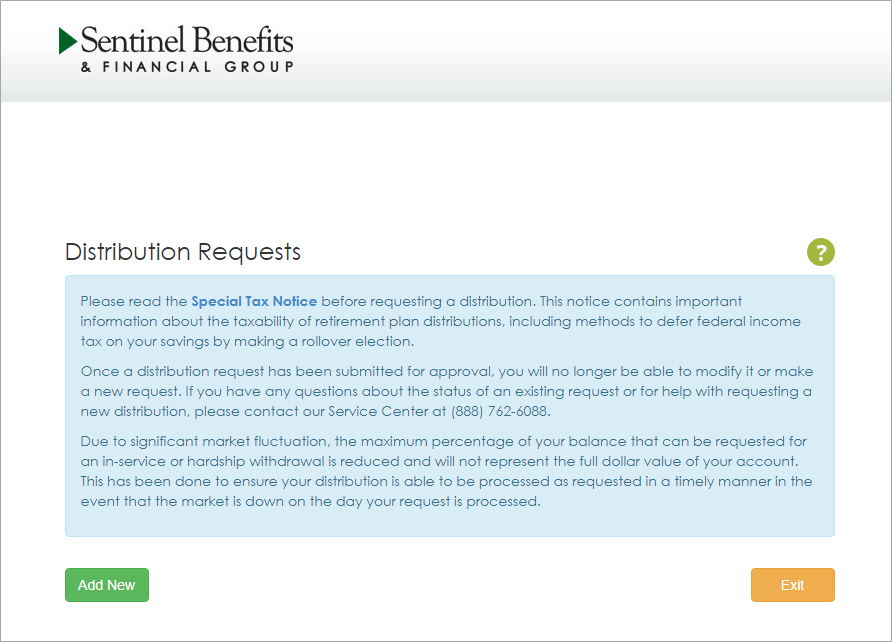

- Select Add New

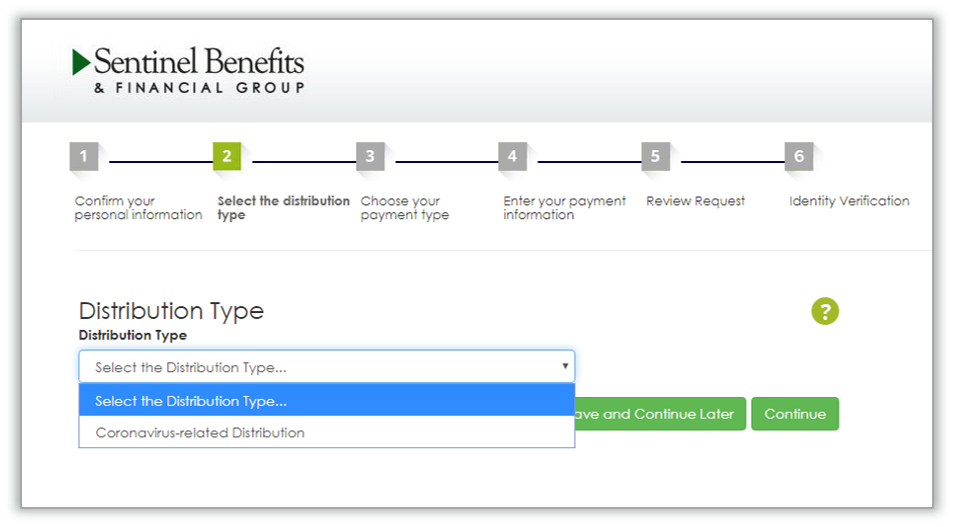

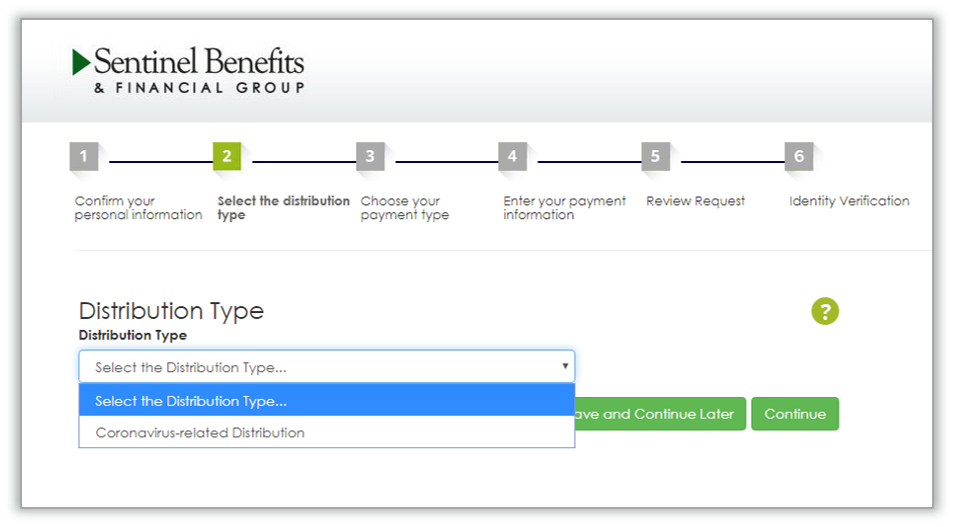

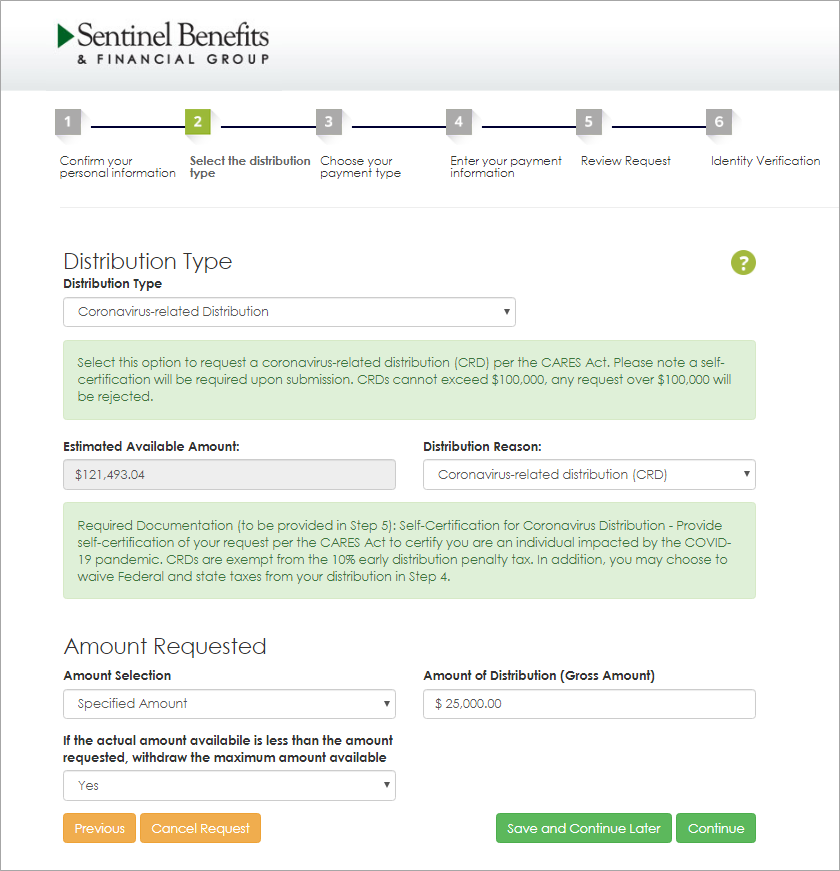

- Select Coronavirus-related Distribution

- Next you'll be presented with the notification of the requirement to self-certify your request prior to submission

- Enter your requested amount for distribution (Note: This amount cannot exceed $100,000 across all of your retirement plans)

- Click Continue to advance and select how you'd prefer to receive your distributions (check or direct deposit/ACH).

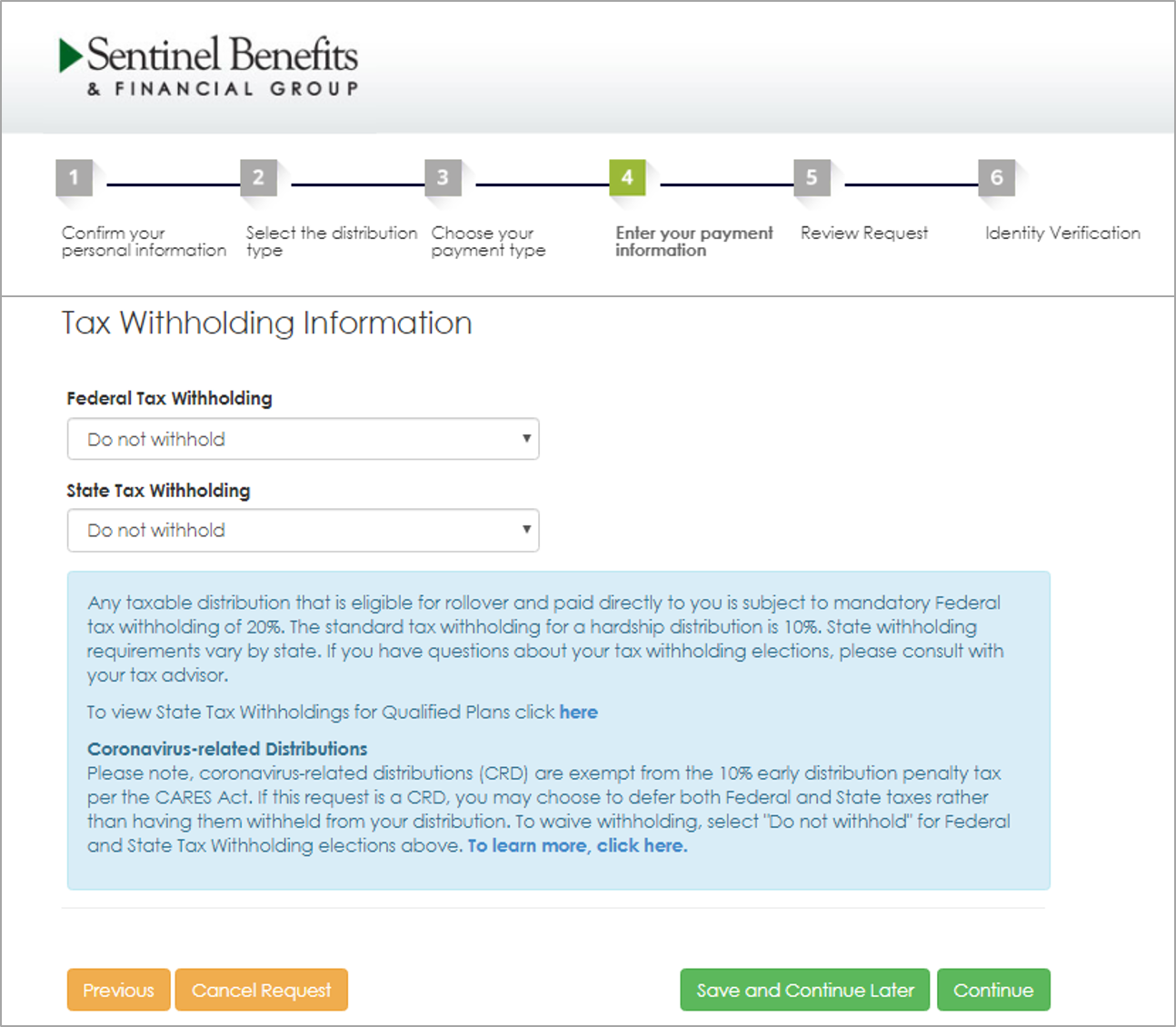

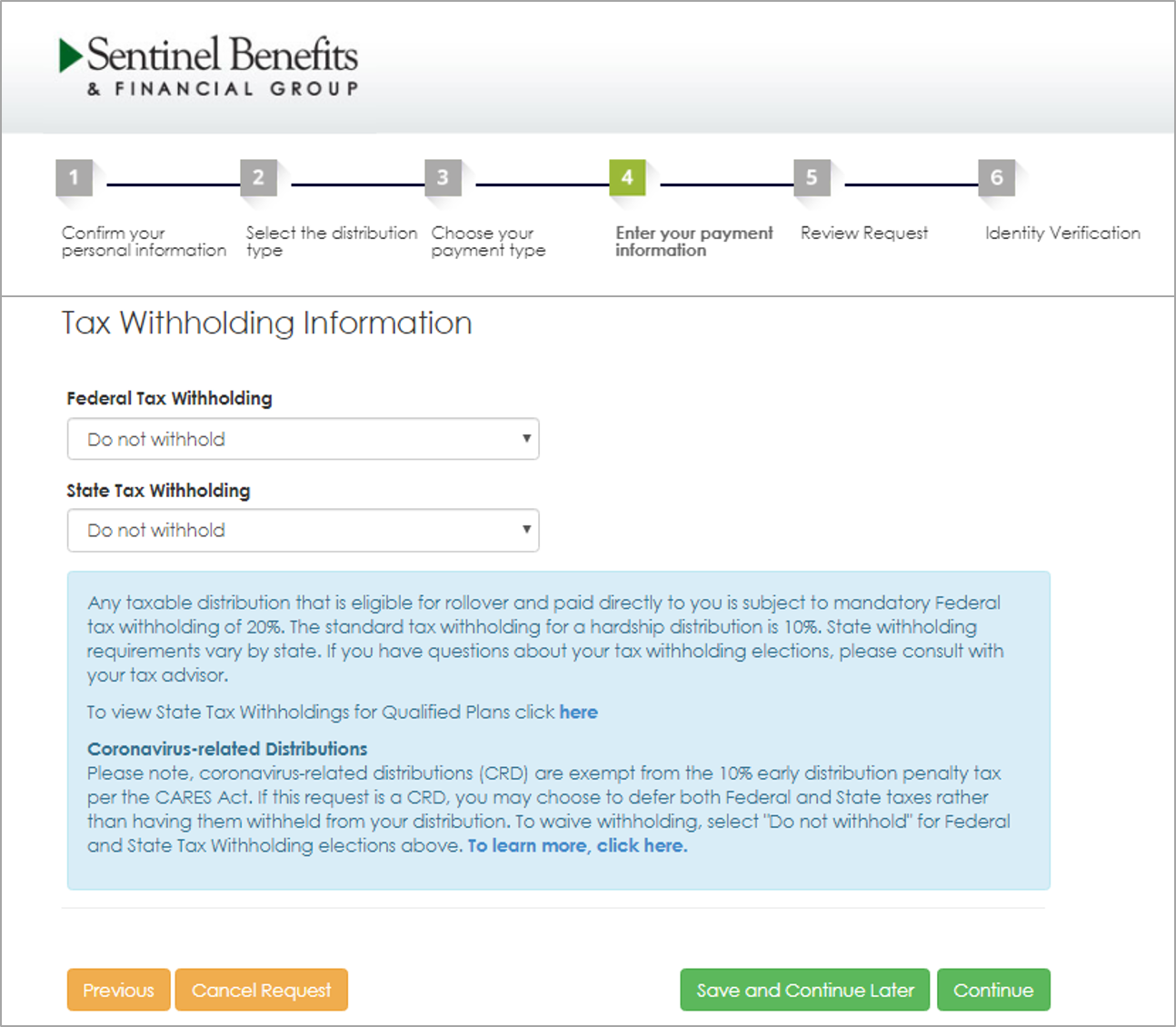

- Scroll down to your tax withholding options. You may choose to waive required Federal and state withholding for your CRD.

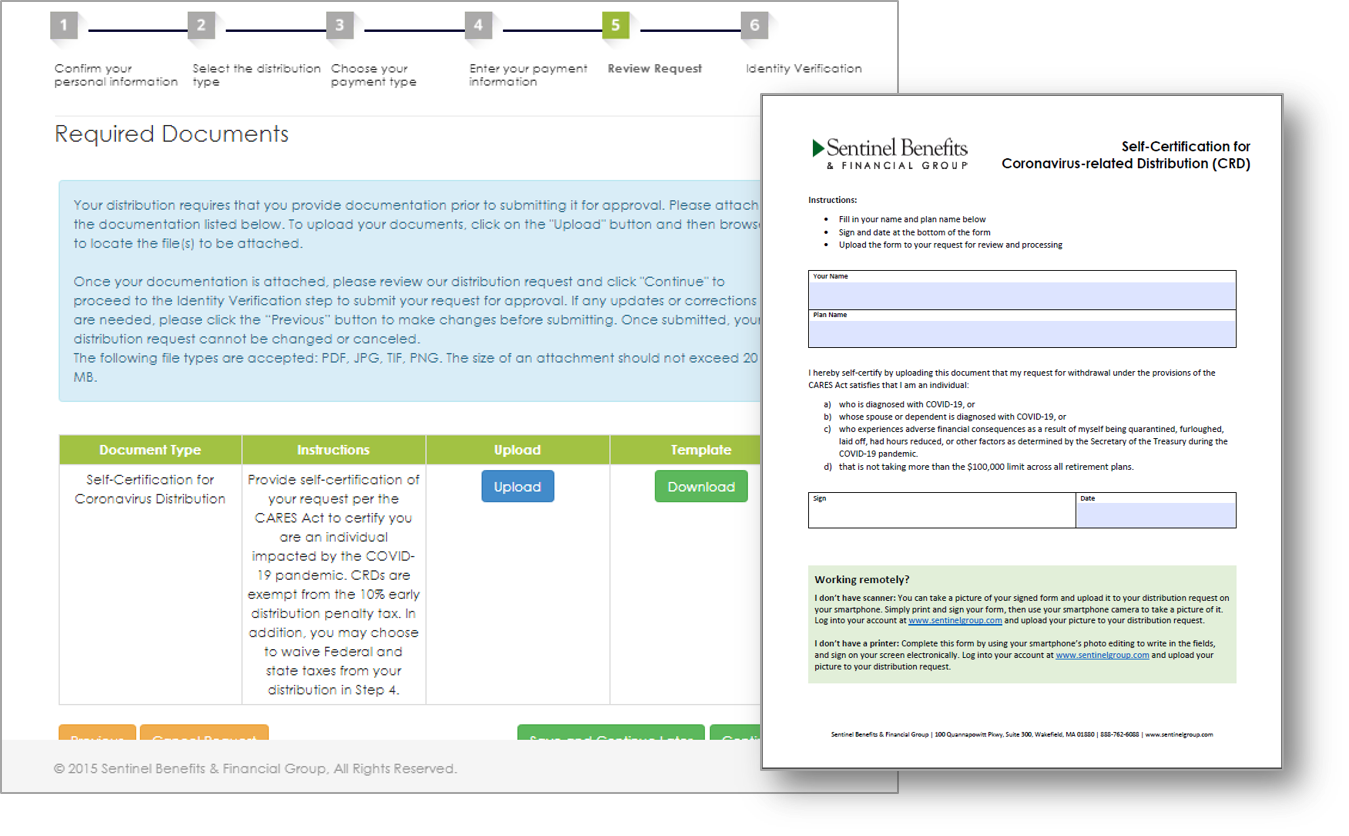

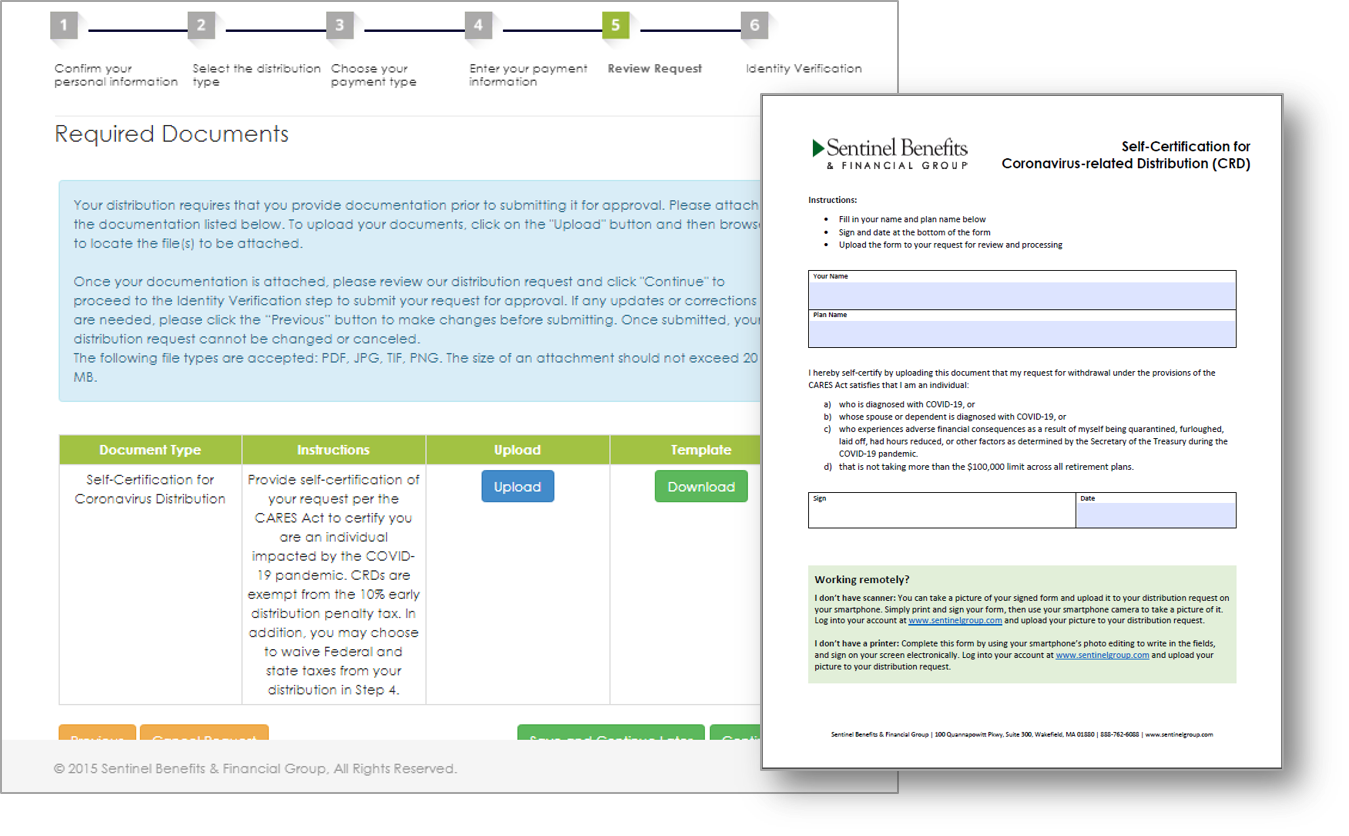

- Click Continue to advance to review your request and provide your self-certification.

- For the self-certification, click Download to retrieve the PDF self-certification form. Complete it and click Upload to provide the completed copy and attach it to your request.

- Complete the final verification step to submit your CRD.

- Once logged in, participant can select Request a Distribution from the navigation bar

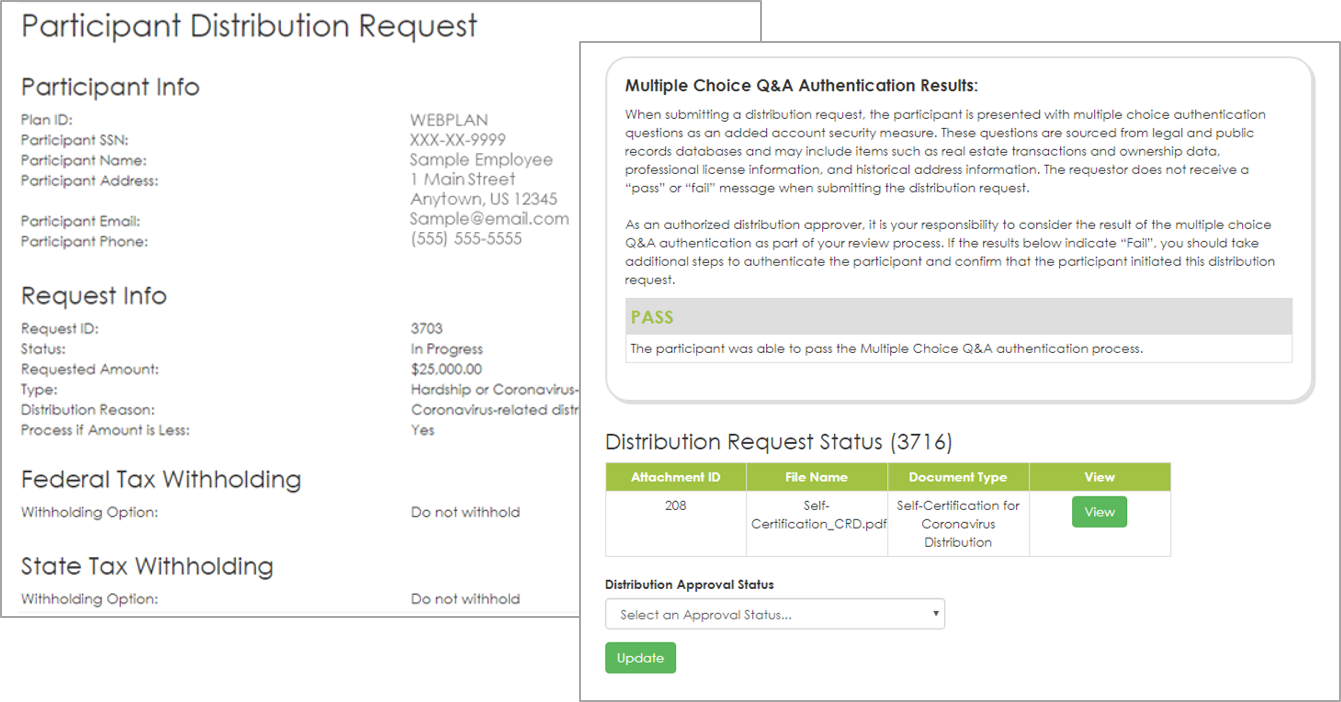

Plan Sponsor Approval

- The Plan Sponsor authorized to approve distributions will receive an email notification when a distribution is ready for your review.

- Log into your online Plan Sponsor Web account and select Distribution Approval from the navigation menu

- Select the distribution

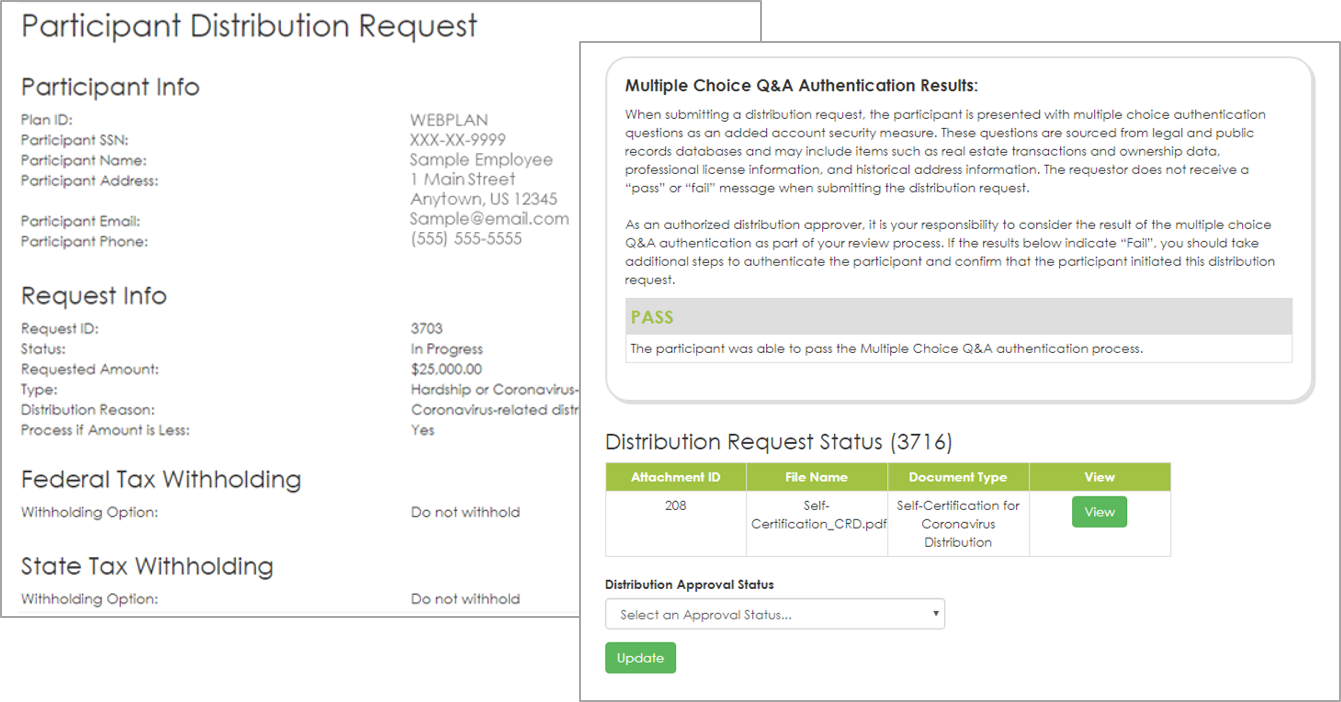

- The Request Summary will provide you with an overview of the request details, participant information, request amount, taxes, etc.

- Scroll down on the Summary page to view the request of the identification questionnaire and the self certification

- Click View and the self-certification document that the participant uploaded to their request will open for your viewing

- In the Distribution Approval Status, you can select Approve or Reject.

- If approved the participant's transaction request will queue for processing. The participant will receive an email that their request has been approved for processing.

- If rejected, you can select a rejection reason and enter notes for the participant. The participant will receive an email that their request has been rejected.