One of the provisions of the SECURE 2.0 Act of 2022 permits plan administrators to rely on a participant’s self-certification that they meet the conditions for a hardship distribution. Under this provision, plan administrators are not required to collect documentation to substantiate the hardship distribution and can instead rely on a participant’s self-certification of the qualifying need.

This new provision is a welcome change, as it reduces the administrative burden on plan sponsors. As such, Sentinel Group will be moving all eligible plans to the self-certification option for hardship distribution requests submitted on or after November 1, 2023.

What do I need to do to adopt the self-certification option for hardship withdrawals?

Nothing! Your plan will automatically be updated to use self-certification for hardship withdrawals beginning on November 1st. Plan amendments needed as a result of this and any other provisions of SECURE Act 2.0 are to be adopted by December 31, 2025.

Can our plan opt out of self certification and continue to require documentation for hardship withdrawals?

While we strongly encourage plan sponsors to adopt this provision, it is optional and you do have the ability to opt out of it. If you elect not to adopt the self-certification option, please notify your Plan Consultant before November 1st.

What will the distribution process look like for participants and distribution approvers?

Participants will be required to agree to a self-certification statement as part of the online distribution process, and their agreement to this statement will be noted on the details of the approval request.

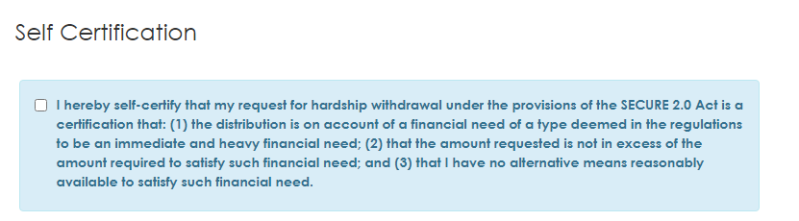

When the Participants is on the Review Request section of their hardship request, they will see a Self Certification Statement. They must acknowledge the statement by clicking the check box or they will not be able to proceed.

The Participant is also required to choose one of the 7 permitted hardship reasons (i.e., medical, educational, funeral, etc.). The Participant Help Center page informs Participants that they should be prepared to provide supporting documentation upon request and includes examples of the types of supporting documentation.

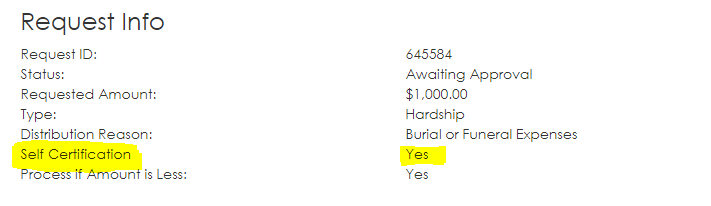

When an authorized approver reviews the hardship distribution, they will see in the details of the distribution that the participant has self-certified.

Are there additional considerations when approving hardship distributions that have been self-certified?

Unless you have actual knowledge that the hardship distribution is not for an allowable reason or the amount exceeds what is required to meet the immediate and heavy financial need, you can rely on the participant's self-certification when approving a distribution.

What if my plan requires spousal consent?

The self-certification option does not change the spousal consent requirement. Participants in plans that require spousal consent will still have to upload a completed Spousal Consent Form, but they can self-certify their need for the hardship distribution.