In this article, we will cover the review process for incoming web-initiated participant rollover requests, the timing of email notifications related to those requests, and detail the supporting documentation provided for your review.

Notifications

| Notification | Details | Next Step |

|---|---|---|

| Rollover into your Company's plan requires your review | Occurs immediately upon receipt of the participant's request. The email notification is sent to any contacts setup to approve money-in/money-out transactions, like distribution withdrawal requests. See the Review Process section below which details the email notification and steps to approve or reject a rollover request. | The participant will be notified of your review when completed.

|

| Reminder - Rollover into your Company's plan requires your review | Occurs three days following the initial review request if the rollover is still awaiting approval | Same as above. |

| Cancellation Notification - Request to roll money into your Company's plan has been cancelled | Occurs if the rollover request remains unapproved for a period of 90 days. You will receive an email notifying you that we have cancelled the request. The Participant will also receive a cancellation notification. | If the participant wishes to proceed with their rollover, they will need to submit a new request. |

Approval Process

For participants rolling money over into your retirement plan, Sentinel makes the process easy. When a participant completes the online form the authorized individuals on the plan will receive an e-mail notification similar to the below.

Request and Email Details:

The approval request email contains key information related to the request and supporting documentation for your review.

- Request Details:

- Request ID: The unique value for the participant's request. If multiple requests are sent in by the same participant, this ID will help distinguish between them.

- Rollover Type: Displays the source(s) selected from the participant's request. This is inclusive of Pretax, Roth, or both (Pretax and Roth). If the plan does not allow Roth, the participant is not presented with the Roth source option during their request.

- Pretax Amount: Displays the pretax rollover amount provided by the participant.

- Roth Amount: Displays the summation of the Roth basis and Roth earnings amounts provided by the participant.

- Rolling From: Displays the account type that the participant selected for the origin of their rollover. This includes a qualified plan (ex: 401(k) plan), IRA rollover, 403(b) plan, etc. This field will be included in the Approval Web Form.

- Attachments:

- Participant Request Form: Provides a PDF copy of the participant's rollover request. This is inclusive of the rollover source(s), amounts, and prior account type (qualified plan, etc.).

- Supporting Documentation (if applicable): If your plan requires participants to provide additional documentation during their rollover request, we will include the uploaded additional documentation that they provide. Participants are instructed to provide one of two acceptable forms of supporting documentation.

- Letter of Authorization (LOA) from the Financial Institution that is providing their rollover check. A Letter of Authorization for rollovers will typically contain the plan name, plan type, and confirmation of the money types being rolled over.

- A copy of their most recent statement for your account where the funds are coming from. This statement must show a breakdown of their balance by money sources (pre-tax, Roth, etc.) related to this request.

- Note: Please contact your Sentinel Plan Consultant if you'd like to enable the Supporting Documentation feature for these requests.

Approval Web Form

To review the participant request, please click the Review Rollover Request button in your email. The details provided in the form are pre-filled based on the participant's initial request -- including the Rolling From field which details the source of the participant's rollover funds.

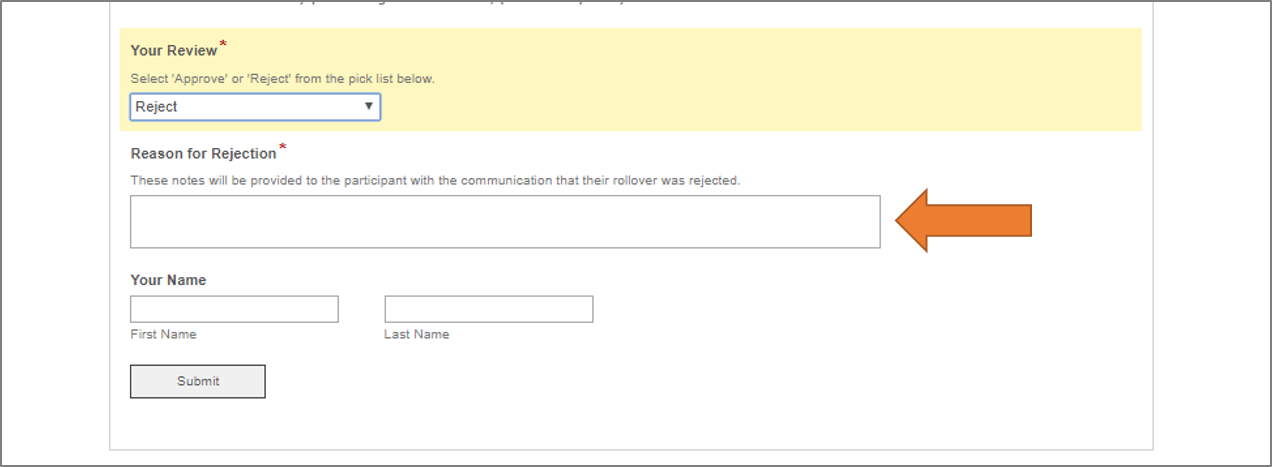

- Navigate to Your Review section and select an option from the pick list - Approve or Reject

- If approved, the participant will be notified to send their rollover to the Plan's account.

- If rejected, please provide the Reason for Rejection. This data will be routed to the participant via email so they are aware why their rollover was not accepted. (example image below)

- Enter your name as the reviewer. This will be attached to the participant's original request so all the proper documentation is archived related to their request.

- Click Submit.

Rejection Example:

Participant Process

For more information on how the participant process works, please visit: http://help.sentinelgroup.com/help/rolling-money-into-my-plan-at-sentinel